Bitcoin continues to face resistance at the psychologically important $100,000 threshold, and there has been a shift in investor focus from BTC to altcoins. Notably, tokens that rallied in the 2021 bull run and metaverse tokens like Decentraland and Sandbox have witnessed a resurgence in trade volume across centralized exchanges like Upbit.

Ethereum (ETH) has observed a spike in open interest driven by a heightened demand among derivatives traders. The rise is supported by metrics that reveal a growing bullish sentiment among market participants. An Ethereum price rally is likely in the short term as institutional interest broadens and traders diversify their portfolios to include tokens with potential for gains in this market cycle.

Bitcoin struggles under $100,000, altcoins offer an opportunity for trade

Bitcoin missed the $100,000 target by less than $500 on Friday, November 20. Since its first attempt at hitting the threshold, Bitcoin has slipped nearly 5% lower, to $95,719 on Thursday, November 28.

Institutional investors have pulled capital from Bitcoin ETFs this week; data from Farside Investors shows $435.30 million in outflows on Monday and $122.80 million on Tuesday.

As Bitcoin consolidates and altcoins from previous bull markets rally, institutional investors shift their focus to Ethereum and other alternatives that could yield higher returns in the coming weeks.

Altcoins like Cardano (ADA), Ripple (XRP), Stellar (XLM), and metaverse tokens like Decentraland (MANA) and Sandbox (SAND) have witnessed a spike in trade volume this week across centralized exchanges. South Korean cryptocurrency exchange Upbit recorded several consecutive days of increase in trade volume across the fiat pairs of metaverse tokens and altcoins from the 2021 bull run.

Data from 10xResearch recorded the spike and identified the altcoins in the chart below.

Trade activity on South Korean exchanges is typically considered a precursor for spot trading across centralized exchanges worldwide. Altcoins like Sei, Polkadot (DOT), and Dogecoin (DOGE) are gaining relevance among market participants.

Ethereum derivatives traders turn bullish on ETH

Among the altcoins that rallied in the past week amidst Bitcoin’s consolidation, Ethereum is at the top of the list. Derivatives traders have turned increasingly bullish on Ether, and there is a shift in institutional investor sentiment.

Farside Investor data shows that institutional investors’ interest in Ethereum ETFs is slowly recovering with moderate inflows to the asset. This week, Ethereum ETFs recorded $133.60 million in inflows.

Derivatives market data shows that open interest in Ethereum has climbed past $24 billion, a four-month peak. Even as the Ethereum spot market price is slow to catch up with the open interest, derivatives traders expect the ETH price to climb.

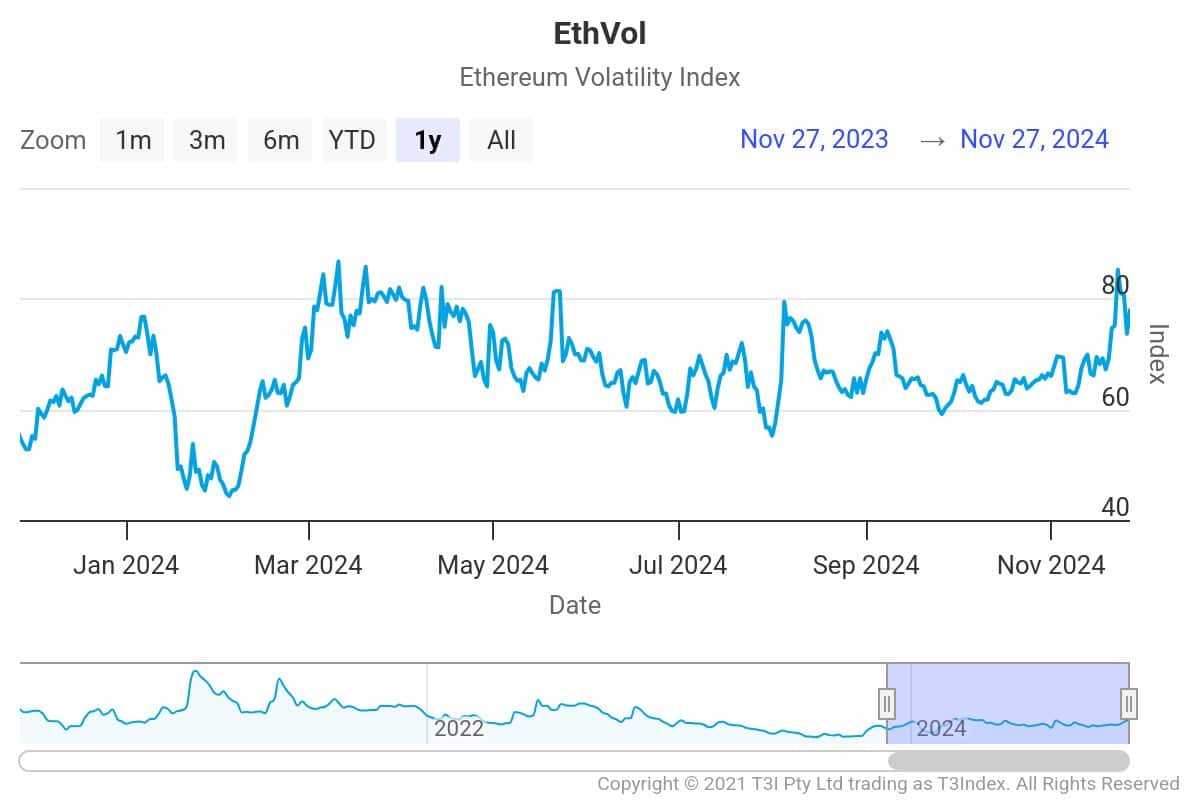

Ethereum recorded a spike in its implied volatility between November 14 and 27, while Bitcoin’s IV is relatively flat. Market participants expect a likely movement in Ethereum price while Bitcoin consolidates, affirming the bullish thesis for the altcoin.

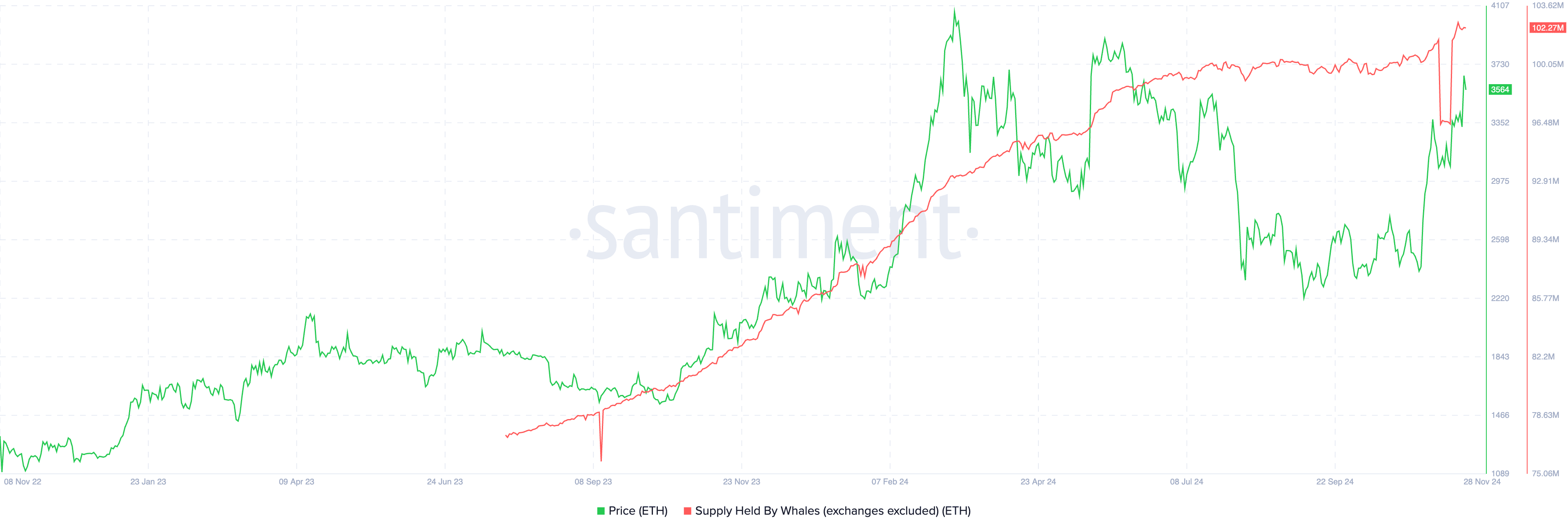

In the past eight days, Ethereum whales have increased their ETH holdings by 6%, to $102.27 million on Thursday. A rise in accumulation by whales is typically considered bullish for a token. Large wallet holders are known to increase their holdings in anticipation of price gains in a token.

Santiment data shows a spike in Ethereum prices in the weeks and months following accumulation by whales, recorded by the supply held by whales (excluding exchanges) metric.

Recent events point at major win for the Ethereum ecosystem

A U.S. court of appeals overturned sanctions against Tornado Cash, a crypto mixer on the Ethereum blockchain. In 2022, a court accused the firm of laundering over $7 billion for North Korean hackers and malicious entities.

Chief Legal Officer of Coinbase, Paul Grewal, said that Tornado Cash’s smart contracts must now be removed from the sanctions list. U.S.-based individuals will now be allowed to use the privacy-protecting protocol.

With Donald Trump’s win in the recent Presidential elections, U.S.-based traders are hopeful of a shift in regulatory stance on crypto and policymaking in 2025. The upcoming developments could act as a catalyst for Ethereum’s price.

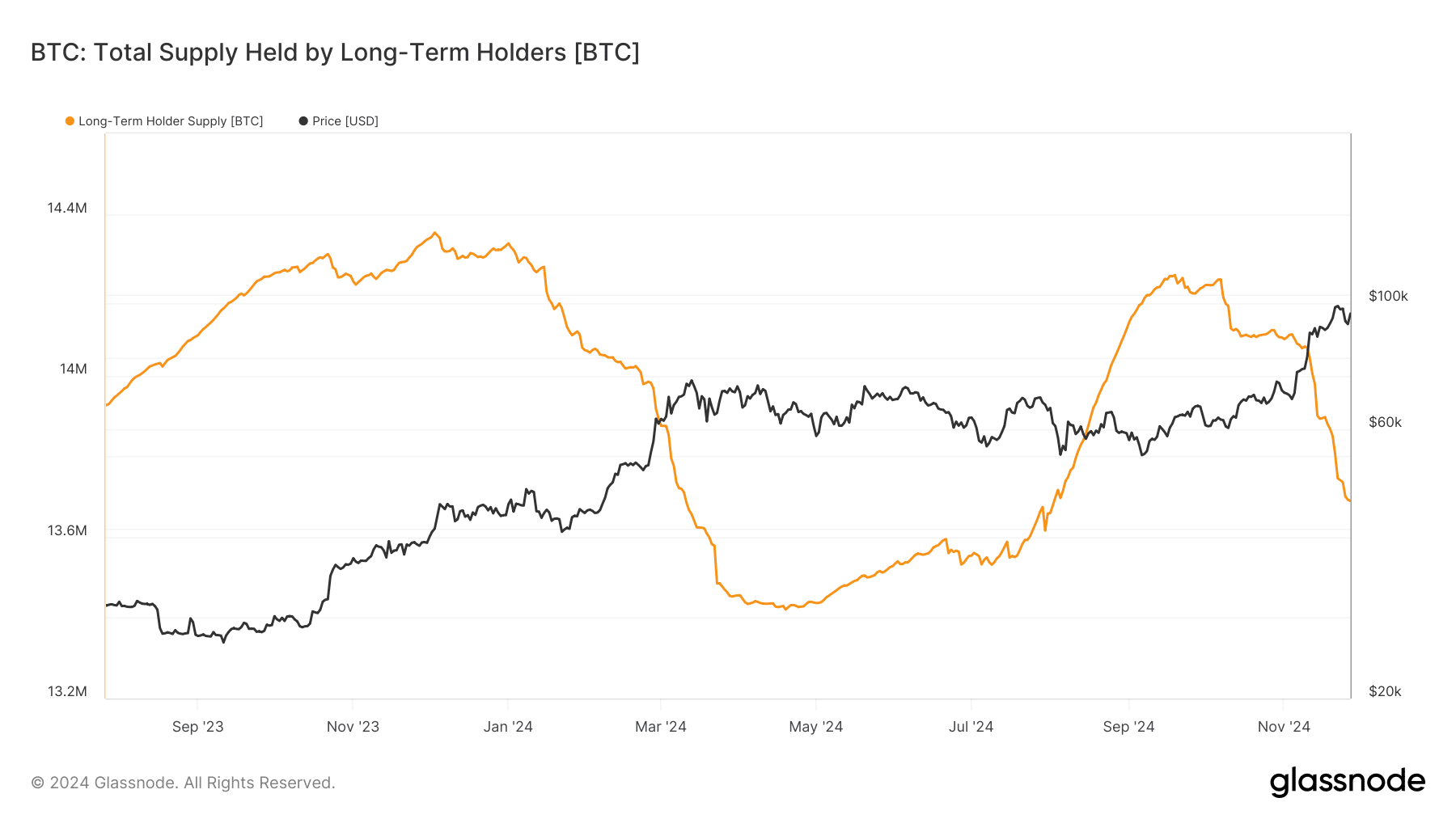

Long-term Bitcoin holders are selling their BTC

Long-term holders of Bitcoin decreased their BTC holdings by nearly 3% in November, down from 14.09 million to 13.69 million BTC. As Bitcoin supply held by the category of holders dwindles, it raises cause for concern regarding selling pressure on the asset.

Bitcoin price has yet to see a negative impact from the profit-taking, and demand has absorbed the supply of BTC being sold by long-term holders as of Thursday.

Traders need to keep their eyes peeled for further decline in long-term holders’ BTC holdings, as this could signal incoming selling pressure and an extended correction in Bitcoin.

Strategic considerations: Bitcoin and Ethereum

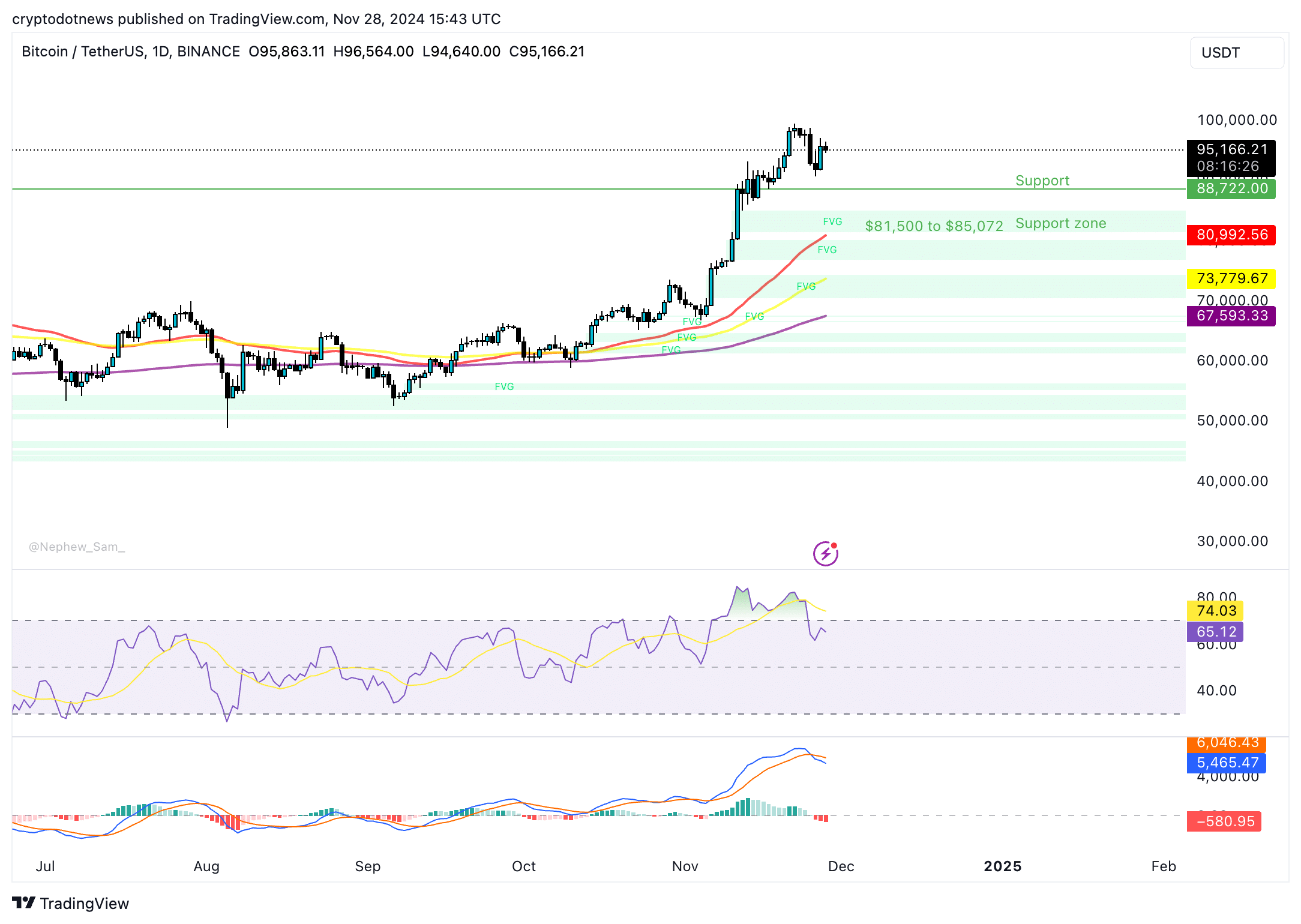

Bitcoin started consolidating after it attempted to rally to the $100,000 target. The closest support for BTC is $88,722, the November 17 low. BTC could find support in the imbalance zone between $81,500 to $85,072.

The momentum indicator relative strength index is sloping downward and reads 65. Moving average convergence divergence flashes red histogram bars under the neutral line, signalling a negative underlying momentum in the Bitcoin price trend.

Traders need to watch the Bitcoin price chart and technical indicators closely for signs of a reversal in the coming weeks.

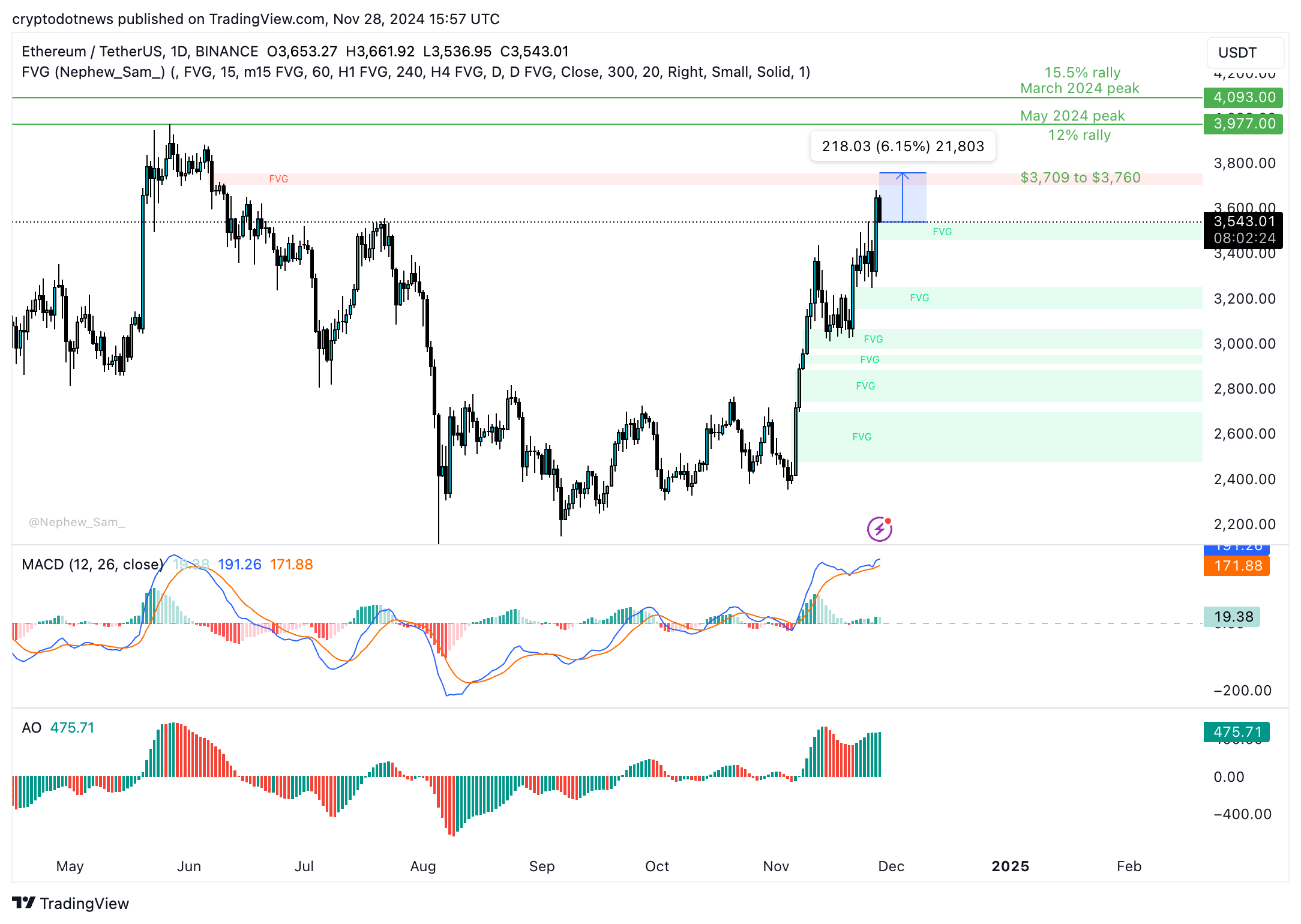

Ethereum could rally towards the imbalance zone between $3,709 and $3,760, marking 6% gains from the current price. Once ETH closes above this level, the May 2024 peak of $3,977 and the March 2024 peak of $4,093 are the two key resistance levels for the altcoin.

The MACD and awesome oscillator support the thesis of a positive underlying momentum in the Ethereum price. ETH could extend its gains while Bitcoin consolidates, offering an opportunity to sidelined buyers before the end of 2024.

The three-month correlation between Bitcoin and Ethereum is 0.95, meaning traders need to observe BTC for signs of a steep correction. A sudden reversal in Bitcoin’s price trend could impact Ethereum traders and long positions in ETH, therefore warranting strategic considerations.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Discover more from myNFTledger.com

Subscribe to get the latest posts sent to your email.